Navigating the dynamic world of cryptocurrency trading requires a reliable and secure platform. Choosing the right exchange is paramount for a successful trading journey, whether you're a seasoned investor or just starting. This comprehensive guide explores the top cryptocurrency exchange platforms, providing an in-depth analysis of their features, fees, security measures, and overall suitability for different trader profiles. We'll delve into the critical factors to consider when selecting an exchange, equipping you with the knowledge to make informed decisions and maximize your trading potential.

Understanding Your Trading Needs:

Before diving into the specifics of each platform, it's essential to identify your individual trading requirements. Consider the following questions:

- What cryptocurrencies are you interested in trading? Some exchanges specialize in specific coins or offer a broader selection.

- What is your trading experience level? Beginner-friendly interfaces differ significantly from platforms designed for advanced traders.

- What are your preferred payment methods? Exchanges vary in their supported deposit and withdrawal options.

- What is your risk tolerance? Consider factors like security measures, regulatory compliance, and platform stability.

- What are your fee sensitivities? Trading fees, deposit/withdrawal fees, and other charges can significantly impact profitability.

Key Evaluation Criteria for Crypto Exchanges:

This guide utilizes the following criteria to evaluate and rank the top cryptocurrency exchange platforms:

- Security: Robust security measures, including two-factor authentication (2FA), cold storage, and encryption protocols are crucial for protecting your assets.

- Fees: Transparency and competitiveness of trading fees, deposit/withdrawal fees, and other charges are essential considerations.

- Available Cryptocurrencies: A diverse selection of cryptocurrencies caters to various investment strategies and portfolio diversification.

- Payment Methods: Multiple payment options, including bank transfers, credit/debit cards, and cryptocurrency deposits, enhance convenience.

- User Interface: An intuitive and user-friendly interface simplifies trading and portfolio management for both beginners and experienced traders.

- Customer Support: Responsive and reliable customer support is vital for addressing any issues or concerns promptly.

- Regulation and Compliance: Adherence to regulatory guidelines and licensing requirements ensures a secure and trustworthy trading environment.

- Trading Volume and Liquidity: High trading volume and liquidity facilitate efficient order execution and minimize price slippage.

- Advanced Trading Features: Margin trading, futures trading, options trading, and other advanced features cater to experienced traders.

- Educational Resources: Educational materials, tutorials, and market analysis tools empower users to make informed trading decisions.

2024's Best 15+ Crypto Exchanges: In-Depth Analysis & Comparison

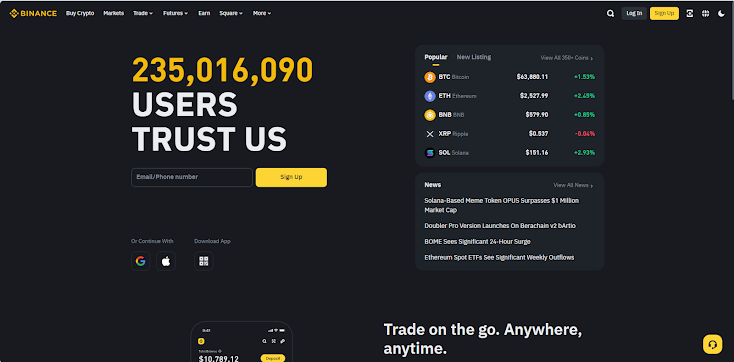

1. Binance:

- Overview: Binance is the world's largest cryptocurrency exchange by trading volume, known for its vast selection of cryptocurrencies, competitive fee structure, and advanced trading features. It caters to both beginners and experienced traders.

- Features: Spot trading, margin trading, futures trading, options, staking, lending, Launchpad (IEO platform), NFT marketplace, Binance Academy (educational resources), P2P trading.

- Fees: Maker/taker fees starting at 0.1%, with significant discounts for higher trading volumes and BNB (Binance Coin) holders. Withdrawal fees vary by cryptocurrency.

- Security: Two-factor authentication (2FA), device management, address whitelisting, cold storage for a significant portion of user funds. While Binance has experienced security incidents in the past, they have invested heavily in improving their security measures.

- Pros: Wide range of cryptocurrencies, high liquidity, low fees, advanced trading tools, user-friendly interface for both beginners and experienced traders, robust mobile app.

- Cons: Regulatory scrutiny in various jurisdictions, past security breaches, customer support can sometimes be slow to respond.

2. Coinbase:

- Overview: A user-friendly platform ideal for beginners, Coinbase prioritizes ease of use and regulatory compliance. It's a good starting point for those new to cryptocurrency.

- Features: Spot trading, recurring buys, Coinbase Wallet, Coinbase Earn (learn and earn rewards), Coinbase Pro (advanced trading platform for experienced traders).

- Fees: Generally higher fees compared to Binance, with a tiered structure based on trading volume. Withdrawal fees vary depending on the method and currency.

- Security: Two-factor authentication (2FA), cold storage for the majority of user funds, FDIC insurance for USD balances. Coinbase has a strong focus on regulatory compliance.

- Pros: Beginner-friendly interface, strong security, regulatory compliance, excellent educational resources, available in many countries.

- Cons: Limited selection of cryptocurrencies compared to Binance, higher fees, limited advanced trading features on the main platform (Coinbase Pro offers more advanced features).

3. Bybit:

- Overview: Bybit is a cryptocurrency derivatives exchange known for its focus on futures and perpetual contracts trading. It caters to more experienced traders and offers high leverage and advanced trading tools.

- Features: Perpetual contracts, futures contracts, options, spot trading (limited selection), copy trading, margin trading. Bybit also offers a launchpad for new projects and various earning products.

- Fees: Bybit uses a maker/taker fee model, which is competitive within the derivatives trading space. They offer discounts based on trading volume and holding BIT, their native token.

- Security: Bybit employs standard security measures, including two-factor authentication (2FA), cold storage of funds, and regular security audits. They have a generally good security track record.

- Pros: Wide range of derivatives products, competitive fees, high leverage options, user-friendly platform, mobile app availability.

- Cons: Primarily focused on derivatives trading, limited spot market, not available in all regions due to regulatory restrictions, customer support can sometimes be slow.

4. OKX:

- Overview: OKX (formerly OKEx) is a global cryptocurrency exchange offering a wide range of trading products and services, including spot trading, derivatives, DeFi, and NFTs. They cater to both retail and institutional investors.

- Features: Spot trading, margin trading, futures trading, perpetual swaps, options trading, DeFi staking, lending, borrowing, NFT marketplace, OKX Earn (for earning passive income).

- Fees: OKX uses a maker/taker fee model, which is generally competitive. Fees can be further reduced based on trading volume and holding OKB, their native token.

- Security: OKX employs standard security measures, including two-factor authentication (2FA), cold storage for funds, and regular security audits. They have had a security incident in the past, which temporarily halted withdrawals, but have since taken steps to improve security.

- Pros: Wide range of trading products and services, competitive fee structure, high liquidity, global reach, user-friendly interface, mobile app availability.

- Cons: Past security incident, regulatory uncertainty in some jurisdictions, some complexity for beginners navigating the wide range of products. Customer support can sometimes be challenging to reach.

5. Kraken:

- Overview: A secure and reliable exchange catering to both retail and institutional investors, Kraken emphasizes security and regulatory compliance.

- Features: Spot trading, margin trading, futures trading, staking, over-the-counter (OTC) trading for large volume transactions.

- Fees: Maker/taker fees starting at 0.16% and 0.26%, respectively, with volume discounts available for active traders.

- Security: Two-factor authentication (2FA), cold storage, PGP encryption for communication. Kraken has a strong track record of security and has not suffered major breaches.

- Pros: Strong security, regulatory compliance, wide range of cryptocurrencies, advanced trading tools, good customer support.

- Cons: Interface can be less intuitive for beginners compared to Coinbase, fewer educational resources.

6. Gemini:

- Overview: A US-based exchange founded by the Winklevoss twins, Gemini focuses on security, regulatory compliance, and institutional-grade services.

- Features: Spot trading, Gemini ActiveTrader (advanced trading platform), Gemini Earn (interest-bearing accounts), Gemini Custody (institutional custody solutions).

- Fees: Auction-based fee structure, generally higher than Binance and Kraken. The fee structure can be complex.

- Security: SOC 1 Type 2 and SOC 2 Type 2 certified, full-reserve exchange and custodian, regulated by the New York Department of Financial Services (NYDFS).

- Pros: Strong security, regulatory compliance, user-friendly interface, good customer support, transparent and trustworthy.

- Cons: Limited selection of cryptocurrencies, higher fees, limited advanced trading features compared to some competitors.

7. KuCoin:

- Overview: Known for its wide selection of altcoins and competitive fees, KuCoin caters to more experienced traders looking for access to a broader range of tokens.

- Features: Spot trading, margin trading, futures trading, lending, staking, KuCoin Win (lottery-style token sales).

- Fees: Maker/taker fees starting at 0.1%, with discounts for holding KCS (KuCoin Shares).

- Security: Two-factor authentication (2FA), industry-standard security practices. KuCoin experienced a significant security incident in 2020 but has since taken steps to improve security.

- Pros: Wide selection of altcoins, low fees, advanced trading features, user-friendly interface.

- Cons: Less regulatory clarity compared to US-based exchanges, past security breach, customer support can be inconsistent.

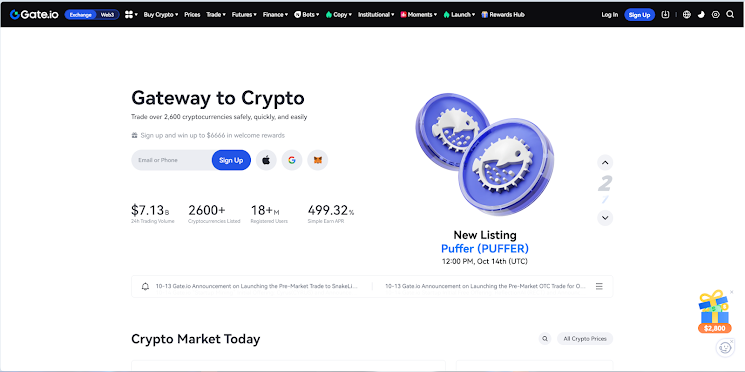

8. Gate.io:

- Overview: A platform with a vast selection of altcoins and a focus on initial exchange offerings (IEOs). It's often a place to find newer, less established tokens.

- Features: Spot trading, margin trading, futures trading, perpetual contracts, lending, Gate.io Startup (IEO platform).

- Fees: Competitive maker/taker fees, with discounts for GT (GateToken) holders.

- Security: Two-factor authentication (2FA), cold storage. Security practices are generally considered standard, but transparency could be improved.

- Pros: Wide selection of altcoins, IEO access, low fees, advanced trading features.

- Cons: Interface can be overwhelming for beginners, less regulatory clarity, customer support can be challenging to reach.

9. Huobi:

- Overview: A global exchange with a strong presence in Asia, Huobi offers a wide range of cryptocurrencies and competitive fees.

- Features: Spot trading, margin trading, futures trading, options trading, staking, Huobi Earn.

- Fees: Competitive maker/taker fees, with discounts for HT (Huobi Token) holders.

- Security: Two-factor authentication (2FA), cold storage. Security has been generally reliable, but transparency is an area for improvement.

- Pros: Wide selection of cryptocurrencies, competitive fees, advanced trading features.

- Cons: Regulatory uncertainty in some regions, some concerns about trading volume accuracy.

10. Bitfinex:

- Overview: A veteran exchange catering to experienced traders, Bitfinex offers advanced trading features and margin trading.

- Features: Spot trading, margin trading, derivatives trading, over-the-counter (OTC) trading.

- Fees: Maker/taker fees based on trading volume, with discounts for large traders.

- Security: Two-factor authentication (2FA), cold storage. Bitfinex has experienced significant security incidents in the past, which impact its reputation.

- Pros: Advanced trading features, margin trading, high liquidity for certain pairs.

- Cons: Complex interface for beginners, past security breaches, regulatory scrutiny, history of controversy.

11. Crypto.com:

- Overview: A rapidly growing exchange with a focus on user experience and a wide range of services, including a Visa card linked to crypto holdings.

- Features: Spot trading, derivatives, staking, Crypto.com Visa Card, DeFi wallet, NFT marketplace.

- Fees: Maker/taker fees vary based on trading volume and CRO (Cronos) staking. Fees can be competitive, especially with CRO staking.

- Security: Two-factor authentication (2FA), cold storage, insurance coverage. Crypto.com has had a security incident in the past.

- Pros: User-friendly interface, wide range of features, competitive fees with CRO staking, good marketing and promotions.

- Cons: Past security incident, some concerns about tokenomics of CRO.

12. Bitget:

- Overview: A cryptocurrency exchange focusing on copy trading and derivatives products.

- Features: Spot trading, futures trading, copy trading, social trading features.

- Fees: Competitive fees, particularly for futures trading.

- Security: Standard security measures, but transparency could be improved. Relatively new compared to other major exchanges.

- Pros: Innovative copy trading features, competitive fees for derivatives.

- Cons: Less established track record, less regulatory clarity.

13. MEXC:

- Overview: MEXC Global is a cryptocurrency exchange known for listing a large number of altcoins and offering a variety of trading services, including spot trading, futures, ETFs, and staking. They often list newer tokens before other major exchanges, making them attractive to those interested in early-stage projects.

- Features: Spot trading, margin trading, futures trading, ETF trading, staking, launchpad (for new projects), MX-DeFi (for decentralized finance services), and a mobile app.

- Fees: MEXC employs a maker/taker fee model, which is generally competitive within the industry. They offer discounts for users who hold their native token, MX. They also run various promotions and fee discount campaigns.

- Security: MEXC uses standard security measures, including two-factor authentication (2FA) and cold storage for the majority of user funds. While they haven't experienced any major security breaches to date, transparency regarding their security infrastructure could be improved.

- Pros: Wide selection of altcoins and trading pairs, competitive trading fees, user-friendly interface, multiple language options, active community, and a variety of trading products.

- Cons: Relatively new compared to some established exchanges, less regulatory clarity, customer support can sometimes be slow to respond, and the sheer number of listed tokens can be overwhelming for new users. It's essential to conduct thorough research on any project listed on MEXC before investing.

14. Binance.TR:

- Overview: The Turkish subsidiary of Binance, catering specifically to the Turkish market.

- Features: Similar features to Binance, but with Turkish Lira (TRY) trading pairs and compliance with Turkish regulations.

- Fees: Similar fee structure to Binance.

- Security: Leverages Binance's security infrastructure.

- Pros: Access to Binance's platform with Turkish language and TRY support.

- Cons: Limited to the Turkish market.

15. BingX:

- Overview: BingX aims to make crypto trading accessible to a wider audience through its copy trading functionality, allowing users to follow and automatically replicate the trades of experienced traders. They emphasize their social trading aspects, creating a community around trading.

- Features: Spot trading, derivatives trading (perpetual contracts), copy trading, demo trading accounts, trading competitions.

- Fees: Competitive and transparent fee structure, with maker/taker fees for spot and perpetual contracts. Fees can be further reduced based on trading volume and BingX token (BX) holdings.

- Security: BingX employs standard security measures, including two-factor authentication (2FA) and cold storage for funds. However, as with any exchange, there are inherent risks in cryptocurrency trading. Transparency regarding security practices could be improved.

- Pros: Easy-to-use copy trading platform, suitable for beginners, competitive fee schedule, active social trading community, demo account for practice.

- Cons: Limited selection of cryptocurrencies compared to larger exchanges, the platform's focus is primarily on derivatives trading, relatively new exchange with a shorter track record.

Types of Cryptocurrency Exchanges:

Understanding the nuances of cryptocurrency exchanges is paramount for making informed decisions about where to trade your digital assets. Choosing the right platform depends on your individual needs, risk tolerance, and trading style. Here's an in-depth look at the various types of cryptocurrency exchanges:

1. Centralized Exchanges (CEXs):

CEXs are the most common type of exchange, acting as intermediaries between buyers and sellers. They are operated by a central authority (a company) and offer several advantages:

- High Liquidity: CEXs typically have large trading volumes, ensuring quick and efficient order execution.

- User-Friendly Interfaces: Designed for ease of use, especially for beginners, with intuitive dashboards and order books.

- Fiat On-Ramps/Off-Ramps: Many CEXs allow users to deposit and withdraw fiat currency (USD, EUR, etc.), making it easy to enter and exit the crypto market.

- Variety of Trading Options: CEXs often offer a wider range of trading pairs, including spot trading, margin trading, futures, and options.

- Customer Support: Most reputable CEXs provide customer support channels to assist users with any issues.

However, CEXs also have some drawbacks:

- Security Risks: Holding funds on a CEX exposes users to the risk of hacking or platform insolvency.

- KYC/AML Compliance: CEXs require users to verify their identity (Know Your Customer/Anti-Money Laundering), which can be a barrier for some.

- Centralized Control: Users do not control their private keys when holding funds on a CEX, giving the exchange custody of their assets.

- Potential for Manipulation: Some CEXs have been accused of wash trading or other manipulative practices.

2. Decentralized Exchanges (DEXs):

DEXs operate without a central authority, utilizing blockchain technology to facilitate peer-to-peer trading. This offers several benefits:

- Enhanced Security: Users retain control of their private keys, reducing the risk of hacking or platform theft.

- Privacy: DEXs often require minimal or no KYC/AML information, providing greater anonymity.

- Censorship Resistance: No single entity can control a DEX, making it resistant to censorship or government intervention.

However, DEXs also face some challenges:

- Lower Liquidity: Trading volumes on DEXs can be lower than CEXs, leading to potential slippage and slower order execution.

- Complex User Interfaces: DEXs can be less user-friendly than CEXs, requiring some technical knowledge to navigate.

- Limited Trading Options: DEXs typically offer fewer trading pairs and may not support fiat currency deposits/withdrawals.

- Smart Contract Risks: DEXs rely on smart contracts, which can be vulnerable to bugs or exploits.

3. Peer-to-Peer (P2P) Exchanges:

P2P exchanges connect buyers and sellers directly, allowing them to negotiate terms and payment methods.- Flexibility: P2P exchanges offer a wide range of payment options, including bank transfers, cash, and gift cards.

- Privacy: Some P2P platforms offer greater privacy than CEXs, with less stringent KYC/AML requirements.

- Global Reach: P2P exchanges can facilitate trading in regions with limited access to traditional financial services.

However, P2P exchanges also have some risks:

- Security Risks: Direct trading with other users carries the risk of scams or fraud.

- Price Volatility: Prices on P2P exchanges can fluctuate significantly due to lower liquidity and negotiated pricing.

- Slower Transaction Speeds: Transactions can take longer to complete compared to CEXs or DEXs.

- Dispute Resolution: Resolving disputes between buyers and sellers can be challenging.

See More: 18 Top Crypto Marketing Agencies: Detailed List & Contact Info 2024

Choosing the Right Exchange:

Ultimately, the best crypto exchange for you depends on your individual needs and preferences. Carefully consider the factors outlined in this guide, conduct thorough research, and compare different platforms before making a decision. Prioritize security, user experience, and the availability of your preferred cryptocurrencies and payment methods. By taking the time to choose the right exchange, you can set yourself up for a successful and secure cryptocurrency trading experience.

Follow and connect with us on:👉 LinkedIn | Facebook | Twitter (X) | Substack |

.webp)