Introduction

In the fast-paced world of blockchain and decentralized finance (DeFi), BBO Exchange (BBOX) stands out as a pioneering project aiming to revolutionize decentralized derivative trading. With a unique approach and a team of experts from both the traditional finance and blockchain industries, BBO Exchange is poised to become DeFi's ultimate derivative trading platform. In this comprehensive analysis, we will delve into the key features, community engagement, documentation, and recent funding milestones of the BBO Exchange project.

Key Features: Empowering Traders and Liquidity Providers

BBO Exchange differentiates itself by offering a range of innovative features designed to enhance the trading experience and provide enhanced yield opportunities for liquidity providers. One notable feature is the incorporation of Oracle Extractable Value (OEV) in its liquidation process, making it the first perpetual DEX to do so. By leveraging an innovative auction mechanism that capitalizes on latency in oracle price updates, BBO Exchange ensures front-running resistance and capital efficiency.

Another standout feature is the multi-asset, signal-driven dynamic distribution Automated Market Maker (AMM). This AMM allows liquidity providers to correlate price ranges with other assets, enabling them to emulate the strategies of proactive market makers while maintaining the ease of passive liquidity provision. This empowers liquidity providers to focus their assets around a dynamic price range, significantly boosting market efficiency. BBO Exchange's user-friendly interface and scalable SDK design cater to both DeFi power users and casual investors, ensuring accessibility for all.

Community Engagement: Building a Thriving Ecosystem

BBO Exchange recognizes the importance of community engagement and has actively fostered a vibrant ecosystem. Through their official Twitter account, BBO Exchange regularly updates the community with exciting news, developments, and industry insights. Additionally, they maintain an active presence on Telegram and Discord, providing a platform for users to interact, seek support, and share ideas. The BBO Exchange community is known for its inclusivity and collaborative spirit, creating a supportive environment for traders and investors.

Documentation: Transparency and Knowledge Sharing

Transparency and knowledge sharing are paramount in the blockchain space, and BBO Exchange excels in providing comprehensive documentation. Their Notion page serves as a central hub for users to access in-depth information about the project. While more documentation is expected to be added in the future, the existing content offers insights into BBO Exchange's vision, technical details, and roadmap. This commitment to transparency establishes trust and helps users understand the project's value proposition.

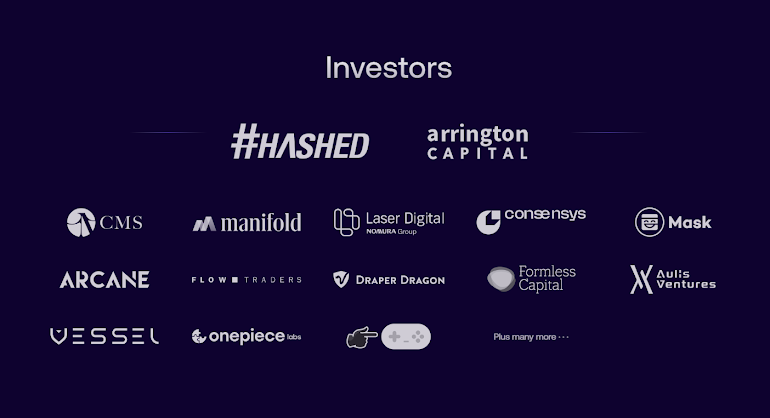

Recent Funding Milestones: Fueling the Vision

BBO Exchange recently closed a $2.7 million pre-seed funding round, co-led by prominent investors Hashed and Arrington Capital. The round also witnessed contributions from industry leaders such as Consensys, CMS Holdings, Flow Traders, Manifold Trading, Mask Network, and Laser Digital (Nomura Group). Notable contributions came from Arcane Group, Draper Dragon, Vessel Capital, Aulis Venture, Formless Capital, Press Start Capital, One Piece Labs, as well as investments from industry veterans Keone Hon and Hongbo Tang. This significant funding demonstrates the trust investors have in BBO Exchange's vision and its potential to bring innovation to the DeFi derivatives space.

Marketing, Market Prospects, and Investment Analysis of BBO Exchange: Insights Unveiled

- Marketing Perspective:

BBO Exchange has a competitive edge in the market due to its unique features and focus on decentralized derivative trading. To effectively market the platform, it is crucial to highlight its key differentiators. Emphasize the benefits of using BBO Exchange, such as its front-running resistance, capital efficiency, and signal-driven dynamic distribution AMM. Showcase how these features empower traders and liquidity providers to maximize profits and optimize yield opportunities.

Utilize social media platforms like Twitter and Telegram to engage with the community, share regular updates, and provide valuable insights into the market and industry trends. Leverage content marketing strategies to create informative blog posts, tutorials, and videos that educate users about the platform's features and functionality. Collaborate with influencers and thought leaders in the blockchain and DeFi space to expand reach and credibility.

- Market Prospects:

The market prospects for decentralized finance and derivative trading are highly promising. DeFi has experienced significant growth in recent years, and the demand for decentralized derivative trading platforms is on the rise. BBO Exchange's innovative approach and commitment to transparency position it well to capture a significant market share.

The increasing adoption of blockchain technology and the growing interest from institutional investors in DeFi further contribute to the favorable market prospects for BBO Exchange. As the platform continues to enhance its features, expand its ecosystem, and gain traction within the DeFi community, it is likely to attract more users and liquidity, driving growth and market dominance.

- Investment Analysis:

Investing in BBO Exchange presents an opportunity to participate in the rapidly evolving decentralized finance space. The successful pre-seed funding round, with participation from reputable investors and industry leaders, signifies confidence in the project's potential. However, it is essential to conduct thorough due diligence before making any investment decisions.

Consider factors such as the team's experience and expertise, the platform's technological infrastructure, the competitive landscape, and the scalability potential. Assess the market demand for decentralized derivative trading and evaluate how BBO Exchange differentiates itself from competitors. Additionally, monitor the project's roadmap and milestones to gauge its progress and potential for future growth.

Investing in BBO Exchange should be approached with a long-term perspective, as the decentralized finance market is still evolving. It is advisable to consult with financial advisors or professionals experienced in blockchain investments to make well-informed investment decisions.

Note: This analysis is for informational purposes only and does not constitute financial advice. It is crucial to conduct your own research and seek professional guidance before making any investment decisions.

Driving Marketing Success: Key Factors for BBO Exchange to Thrive in the Market

Here are the key factors that a project like BBO Exchange should focus on to achieve marketing success:

1. Clear Value Proposition: Clearly communicate the unique value proposition of BBO Exchange to potential users and investors. Highlight the platform's innovative features, such as Oracle Extractable Value (OEV) and the dynamic distribution Automated Market Maker (AMM), and explain how they differentiate BBO Exchange from competitors.

2. Targeted Audience Segmentation: Identify and segment the target audience based on their needs, preferences, and level of understanding of decentralized finance and derivative trading. Tailor marketing messages and strategies to resonate with each segment, addressing their pain points and showcasing how BBO Exchange can solve their specific challenges.

3. Thought Leadership and Education: Establish BBO Exchange as a thought leader in the DeFi space by providing educational content that helps users understand the benefits and functionalities of decentralized derivative trading. Produce high-quality blog posts, video tutorials, webinars, and whitepapers that empower users to make informed decisions and build trust in the platform.

4. Strategic Partnerships: Collaborate with influential figures, industry experts, and relevant projects in the blockchain and DeFi space. Seek partnerships that align with the vision and values of BBO Exchange to extend the reach and credibility of the platform. Co-marketing initiatives, joint webinars, and content collaborations can help attract a wider audience and strengthen the brand's position.

5. Community Engagement: Foster an active and engaged community around BBO Exchange through social media channels, forums, and dedicated community platforms. Encourage users to share their experiences, ask questions, and provide feedback. Regularly interact with the community, address concerns, and acknowledge valuable contributions to build a strong and supportive user base.

6. Data-driven Marketing Strategies: Utilize data analytics tools to track and analyze marketing campaigns, user behavior, and conversion rates. Optimize marketing strategies based on insights gathered from data, adjusting messaging, targeting, and channels to maximize ROI and improve user acquisition and retention.

7. Continuous Innovation and Adaptation: Stay ahead of market trends and competitors by continuously innovating and adapting to changing user needs. Regularly update and enhance the platform's features based on user feedback and market demands. Position BBO Exchange as a cutting-edge and forward-thinking platform that stays at the forefront of the decentralized finance industry.

By focusing on these key factors, BBO Exchange can position itself strategically in the market, attract a wider user base, and establish itself as a trusted and innovative decentralized derivative trading platform.

👉BBO Exchange (BBOX): Website | Twitter (X) | Telegram | Discord

Conclusion

In conclusion, BBO Exchange is set to disrupt the decentralized derivative trading landscape with its unique features, community engagement, comprehensive documentation, and recent funding milestones. By incorporating Oracle Extractable Value and a dynamic multi-asset signaling AMM, BBO Exchange empowers traders and liquidity providers to maximize their profits and boost market efficiency. With an active and supportive community, transparent documentation, and significant financial backing, BBO Exchange is on track to becoming a leading player in the DeFi ecosystem. As the project continues to evolve and launch its signal-driven AMM on Linea, the future looks promising for BBO Exchange and its mission to redefine decentralized derivative trading.

This article is part of the "Project Collabs" series presented by Fintech24h, a leading blockchain marketing agency, and CMO Intern, a media platform for marketers. Through strategic collaboration, both companies aim to provide in-depth analyses of innovative projects in the decentralized technology space that have the potential to impact various industries at a global scale.

FAQs about BBO Exchange

1. What is BBO Exchange?

BBO Exchange is a decentralized platform that aims to revolutionize derivative trading in the decentralized finance (DeFi) space. It offers innovative features and solutions to empower traders and liquidity providers.

2. What are the key features of BBO Exchange?

BBO Exchange incorporates Oracle Extractable Value (OEV) in its liquidation process, ensuring front-running resistance and capital efficiency. It also offers a multi-asset, signal-driven dynamic distribution Automated Market Maker (AMM) that enables liquidity providers to optimize their yield opportunities.

3. How can I get involved with BBO Exchange?

You can join the BBO Exchange community by following their official Twitter account, joining their Telegram and Discord channels, and signing up for their newsletter to stay updated with the latest news and developments.

4. Is BBO Exchange transparent about its project details?

Yes, BBO Exchange values transparency and provides comprehensive documentation to its users. You can access detailed information about the project, including its vision, technical details, and roadmap, on their Notion page.

5. Has BBO Exchange received any funding?

Yes, BBO Exchange recently closed a $2.7 million pre-seed funding round. The funding round was co-led by Hashed and Arrington Capital, and it received contributions from other industry leaders and notable investors.

6. How can BBO Exchange benefit traders and liquidity providers?

BBO Exchange's innovative features and solutions aim to enhance the trading experience and provide enhanced yield opportunities for liquidity providers. By incorporating OEV and a dynamic multi-asset signaling AMM, BBO Exchange empowers traders to maximize their profits and liquidity providers to optimize their yield while maintaining market efficiency.

Remember, it is always essential to conduct thorough research and seek professional advice before engaging with any investment opportunities or platforms.

.webp)

.png)